Growing your business will probably require you to make significant investment. This can mean borrowing money or sacrificing dividends, which may not be easy and may not be the right thing to do if you do not have the right operating model.

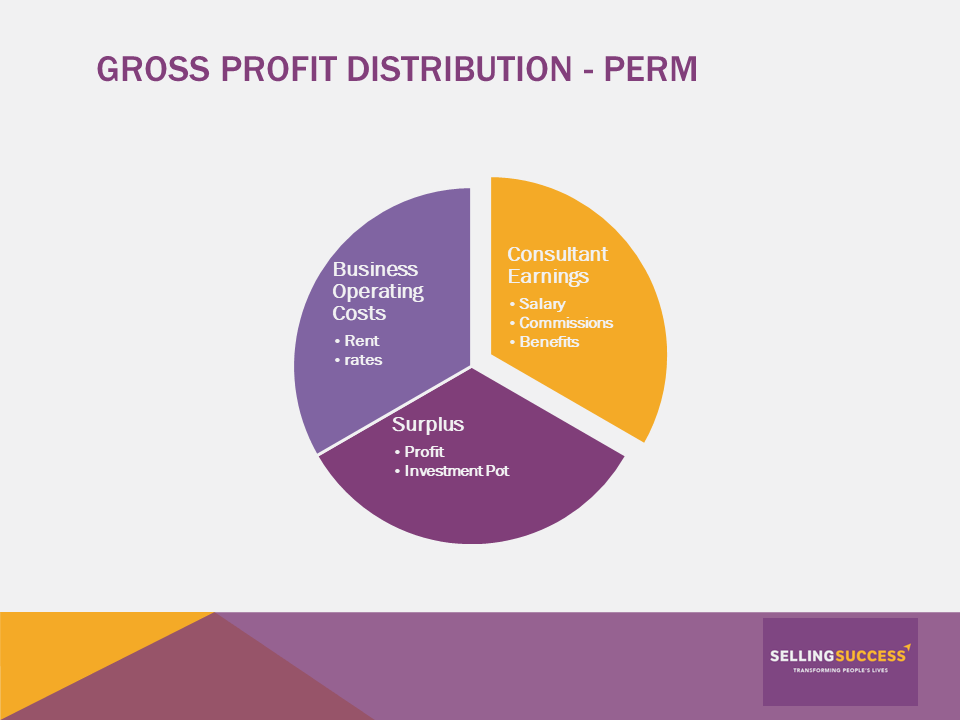

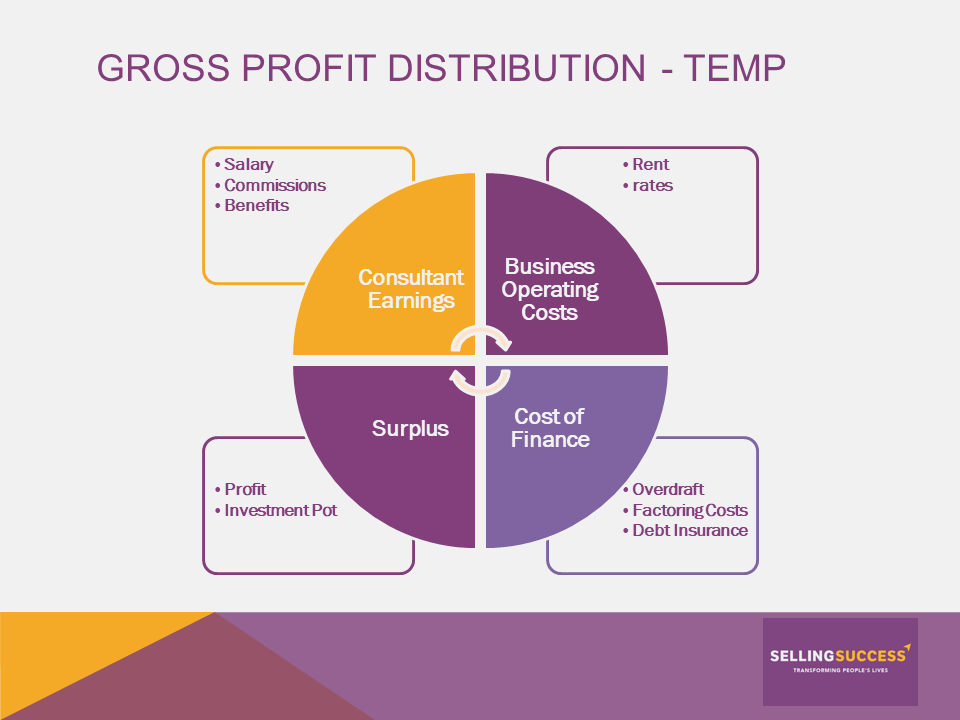

One key discussion for us with clients is do they operate their existing business with the right proportions of:

- Consultant earnings (salary/benefits/commission)

- General business costs/overheads

- Surplus (profit/directors’ dividend)

- Cost of finance

All too often these elements are not in the right proportions. In many cases directors pay their staff too higher percentage of the gross profit/margin consultants generate. Figures as high as 40-50% are not unusual and generally not sustainable in the long run. They will also affect the valuation of your business if you come to sell it.In other situations, clients are paying consultants too low a figure or paying high commission when really the consultants are not ‘generating’ the business themselves but delivering what the directors generate. In other words, the consultants are not self-sustaining 360 consultants but 180-degree account managers.

This can be a highly contentious discussion with directors and consultants a like. It is not easy to change either and has a whole set of challenges associated with it morally, legally and from a perceived ‘fairness’ standpoint. We usually work with consultants, owners and managers to move overtime to a sustainable position, which works for all.

It is a complex situation in most businesses but there are a few guiding principles.

For pure permanent businesses the top three elements; Consultant Earnings; Business Costs and Surplus should be roughly equal 33%.

In a pure temp/contract/interim business the four elements; Consultant Earnings; Business Costs, Cost of finance and Surplus should be generally equal 25% proportions.

Typically, these figures vary slightly but in many cases our client’s surplus figure is too low when we start working with them and this needs to be improved in order to create a self-financing growth plan.

Achieving a healthy surplus is therefore one of our key objectives when we support our clients in the creation of their growth plan and 3-5-year vision for the business.

An experienced Recruitment Business Growth Coach will no doubt have a proven track record of working with agencies like yours and be able to advise and our coaches all have a strong reputation doing this.

There are many other factors you may wish to consider in the equation.

New Starters – Your new starters ‘experienced or trainees’ are very unlikely to hit the ground running so achieving anywhere near the optimum 33% or 25% earnings ratio in the first 3-6 months is virtually impossible. From 6-12 months these should be deliverable and certainly any consultant after 9 months should be achieving these proportions.

New Patches – Moving consultants onto new patches either geographic or niche skill sets requires time to start billing. It’s like a new starter, though the time gap should be shorter.

Over-Achievers – Many times clients allow people over target to have commission plans where the top percentage is over 30% sometimes 40-50%. This is common where the business is small and is designed to get top billers to overachieve. It generally works with the right people, but it distorts your businesses growth plan and when these people become managers and directors and seek an override you as the owners find this becomes unsustainable.

See-Saw Billers – This is mainly an issue with permanent recruitment consultants but is also an issue with temp consultants with a high churn too. Here people fluctuate violently between high percentage pay-out months and months with zero billing. The result is usually over a 4-5-month period that the pay-out ratio is nearer 40%. Again, watch out for this an if necessary, use thresholds and quarterly bonuses to smooth out the payments and reward the stable high billers.

The net effect of all of this is that unless your business costs are under the correct ratio or your cost of finance is better than average the amount of monies that your company must invest in growth is reduced.

All of this is major consideration when you build your growth plan and again an experienced recruitment skilled growth coach will prove invaluable in helping you move to the optimum operating model for your business.

For more information please visit Selling Success or contact Ian Knowlson on 0370 879 0105 or email info@sellingsuccess.co.uk